As the tumultuous month of February unfolded, the bitcoin market experienced dramatic shifts, leading to a resurgence of buying interest among all types of investors. Originally priced at $80,000 at the start of February, bitcoin witnessed a steep decline to $60,000 by February 5. This sharp drop has prompted a notable change in investor behavior, shifting from panic selling to a more coordinated accumulation strategy across various investor categories.

Market Dynamics Shift

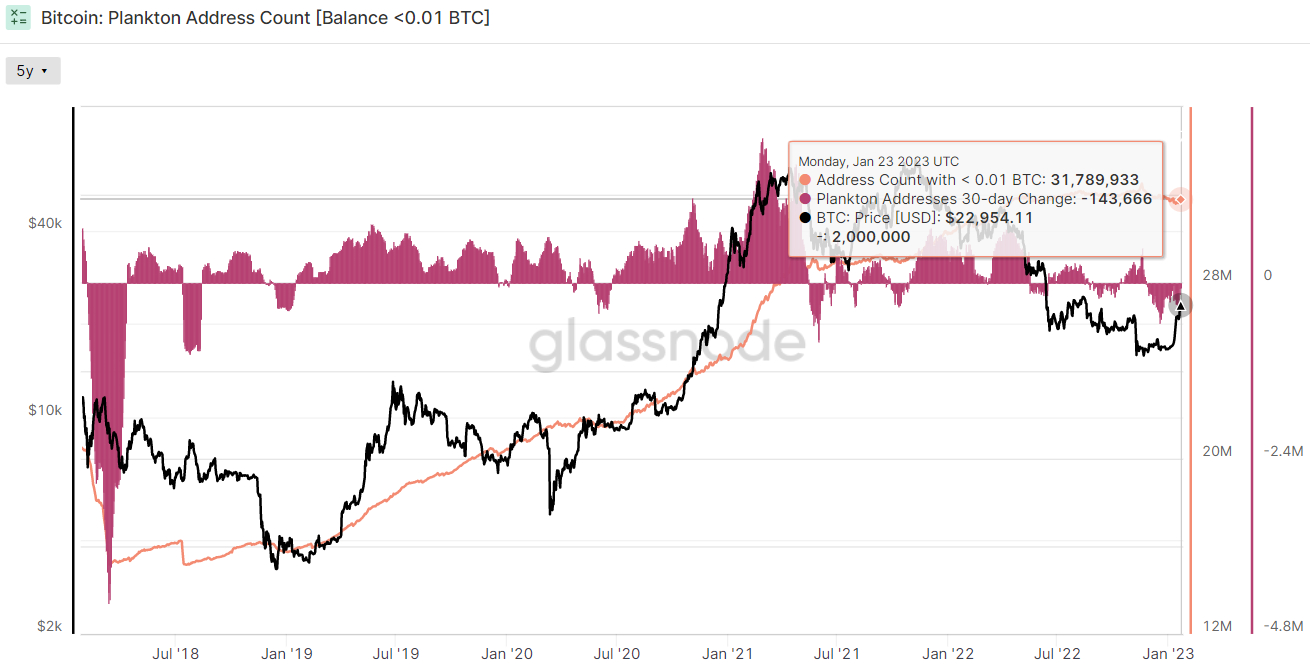

Data from blockchain analytics firm Glassnode reveals a robust trend of accumulation among bitcoin holders following one of the sharpest capitulation events in the cryptocurrency's history. The aggressive selling that characterized the initial days of February is now giving way to a broader re-entry by investors who are starting to view bitcoin as valuable again after a significant price correction.

Glassnode's Accumulation Trend Score, which measures the strength of accumulation across different wallet sizes, indicates this shift. The score evaluates both the entity size and the amount of BTC accumulated over the previous 15 days. A score approaching 1 signals a strong accumulation phase, while a score near 0 reflects distribution. As of now, the Accumulation Trend Score has risen to 0.68, the first time since late November that such a broad-based accumulation has been observed. This uptick in accumulation occurred during a period that previously saw bitcoin forming a local bottom around the $80,000 mark.

Investor Behavior: Who's Buying?

Among the cohorts of investors, those holding between 10 and 100 BTC have demonstrated particularly aggressive dip-buying behavior as prices plummeted. The increase in activity among these mid-tier investors suggests a growing belief that the current price level may represent a significant buying opportunity after the cryptocurrency faced a more than 50% decline from its all-time high reached in October.

While the exact bottom of this market correction remains uncertain, the renewed interest from various investor segments points to a potential recovery. Retail investors, who had initially fled the market during the recent downturn, are now starting to reassess their positions, echoing sentiments shared by larger institutional players.

Outlook for Bitcoin

As the market absorbs the initial shock of February’s volatility, many analysts are watching closely to see if this trend of accumulation will sustain. The shift in market dynamics could indicate that investors are ready to re-enter the market, bolstered by a belief in bitcoin's long-term viability amid fluctuating prices.

This pivotal moment highlights the resilience of the cryptocurrency market and the capacity for rapid behavioral changes among investors in response to price movements. The fact that bitcoin has reached a significant support level may provide hope for those looking to capitalize on its potential upside.

In summary, despite recent turmoil in the bitcoin market, an accumulation trend is emerging, with many investors viewing lower prices as a buying opportunity, hinting at a possible reversal in sentiment among bitcoin holders.

Comments

Post a Comment